Comparison sites dominate UK online financial services market

Price comparison websites still dominate the UK search rankings for financial products, though more 'traditional' brands are beginning to fight back.

Price comparison websites still dominate the UK search rankings for financial products, though more 'traditional' brands are beginning to fight back.

Price comparison websites still dominate the UK search rankings for financial products, though more ‘traditional’ brands are beginning to fight back.

The StickyEyes Consumer Finance Intelligence report finds that the comparison sites have a 62% share of paid and organic visibility, though this is down from 83% last year.

In a nutshell, the price comparison sites were able to gain a lot of ground while the traditional financial companies were still wondering what to do online.

The high street banks have been playing catch up ever since.

This chart of aggregated search volume illustrates the dominance of two main comparison sites: MoneySavingExpert and MoneySupermarket.

Indeed, it’s hard to find a finance-related search that doesn’t return one of the two sites.

In fact, Google’s own comparison service seems to present more of a threat:

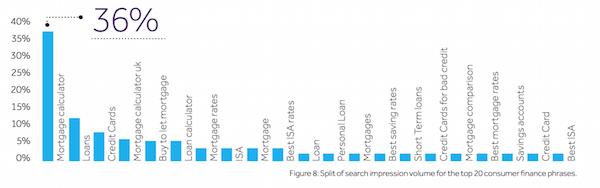

These are the to 20 consumer finance searches. As we can see, mortgages dominate.

What’s interesting here is the popularity of the term ‘mortgage calculator’, to the extent that it seems to be a starting point for many people’s mortgage research.

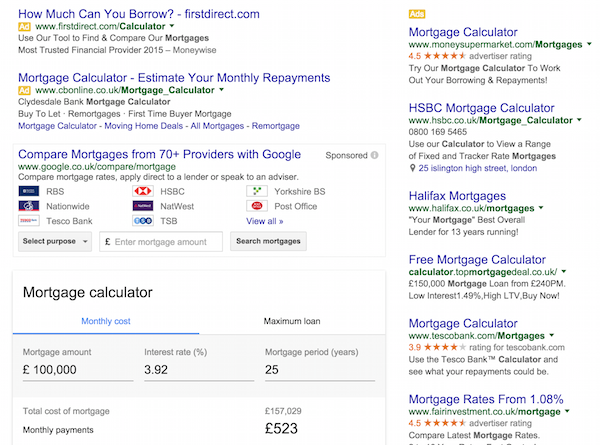

Most of the major banks rank for this term, though MoneySavingExpert takes the top organic slot.

Again, we can see Google muscling in with its own mortgage calculator that pushes the organic results well below the fold.

Overall, mortgage related terms accouted for 46% of search volume across the consumer financial products studied here.

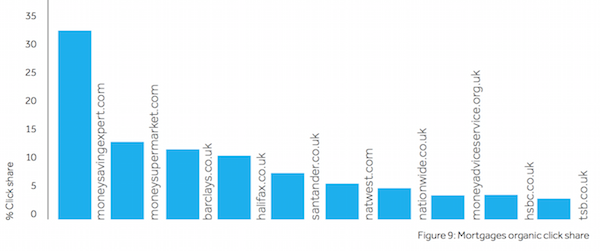

Again, we can see the dominance of the comparison sites in this vertical for organic searches click share.

If we look at paid search click share, we can see that the major banks have been able to buy more visibility.

The price comparison sites, thanks mainly to their organic search rankings, have been able to dominate the search rankings for terms related to financial products.

That is beginning to change, as banks are learning to take search more seriously and implement on-site optimisation and content strategies which will help them to increase their search visibility.

However, as we can see from the Yorkshire Bank example in this article, some still have plenty to learn.

Leave a Reply

You must be logged in to post a comment.