Search Top Priority Among SMBs [Study]

The results of a recent BIA/Kelsey study show that for 2015, search marketing and PPC will be a top priority for many small and medium-sized businesses.

The results of a recent BIA/Kelsey study show that for 2015, search marketing and PPC will be a top priority for many small and medium-sized businesses.

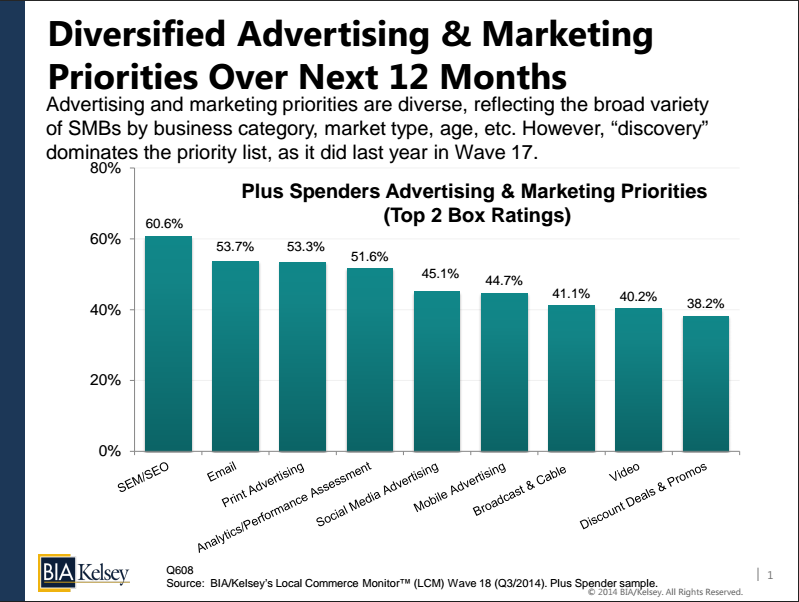

In an effort to determine the priorities of small and medium-sized businesses (SMBs) for the coming year, BIA/Kelsey recently conducted a survey of SMBs that are known for investing more than typical SMBs on advertising and marketing. These businesses are known as SMB Plus Spenders and invest approximately $25,000 to $79,000 annually on advertising and promotion. The results of the survey show that for 2015, these SMBs view search marketing and pay-per-click (PPC) advertising as top priorities.

Steve Marshall is the director of research for BIA/Kelsey. SEW spoke with Marshall to gain some additional insight into the survey and the results.

SEW: It is not surprising that SEO/SEM and email marketing take the number one and two priority spots. However, what is a bit surprising is that print advertising is ranking solidly in position number three. Can you please shed some light on why?

Marshall: First off, print advertising is a very broad category. It includes everything from newspaper advertising to yellow pages, industry-specific magazines, direct mail, and door hangers. In all there are approximately 50 different platforms that fall under this category.

Additionally, traditional or print media is still widely used by numerous SMBs and is a staple for many service providers.

SEW: Can you provide some insight into the types of SMB businesses that you surveyed?

Marshall: We purposefully surveyed a broad spectrum of businesses. We wanted to make sure that each category was widely represented. The businesses surveyed are primarily locally owned and not a part of a larger chain.

Our biggest single category surveyed was General Retail and included businesses such as bicycle shops and gift stores. Trade Services such as plumbers and electricians were also included.

SEW: Were any of the results from the survey unexpected? If so, what stood out the most?

Marshall: The following are the items I found to be most surprising: