CPC Growth Is Down - But Not on Smartphones

Cheaper clicks and mobilegeddon are factors in the increased growth on smartphones, despite CPC's overall decline. CTR, on the other hand, has grown a lot YoY, particularly on Facebook.

Cheaper clicks and mobilegeddon are factors in the increased growth on smartphones, despite CPC's overall decline. CTR, on the other hand, has grown a lot YoY, particularly on Facebook.

Though display CPC growth is on a steady decline, the opposite is true when it comes to smartphones, according to Adobe’s new Digital Advertising Report.

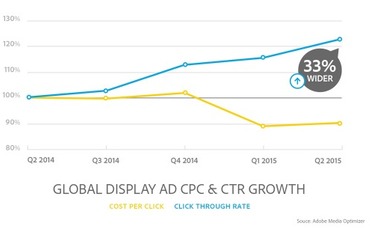

Composed of aggregated, anonymized data over three years, Adobe looked at more than 489 billion digital ad impressions. CTR growth has been increasing consistently, while CPC growth has taken a nosedive over the last year, particularly between Q4 and Q1. There is currently a 33-point gap between the two, despite being fairly equal last year.

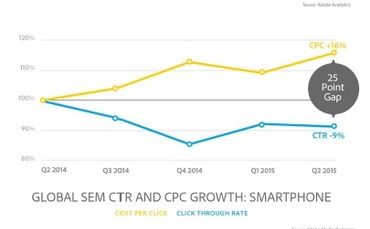

When it comes to smartphones, that gap is reversed. CPC growth is up 16 percent and smartphone CTR is down 9 percent YoY, resulting in a 25-point gap. Adobe research found that “mobilegeddon” was a big factor in the rise of mobile paid search. While the algorithm change seemed inconsistent at the time, organic traffic is up to 10 percent lower among sites with low mobile engagement, according to the report.

Price is another factor in CPC’s continued growth on smartphones. Clicks are significantly cheaper than desktop clicks, though Tamara Gaffney, principal analyst for Adobe Digital Index, doesn’t expect that to last much longer.

“Mobile advertising’s lack of perceived value causes a mobile search click to be worth 37 percent less than a desktop search click,” she says. “Conservative and incremental approaches to tackle ‘mobile stress’ are insufficient to bridge the gap. Disruptive and innovative changes will be required in order to drive future business success on both the publisher and marketer side.”

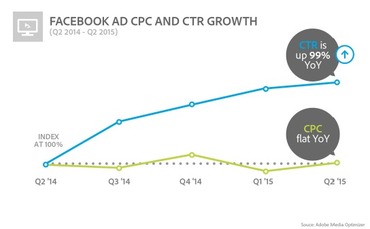

On Facebook, which saw 12 percent more clicks despite half the impressions YoY, the breakdown is more aligned with the global trend. The social media giant’s CPC growth has remained flat, while its CTR growth is up 99 percent YoY. This number dwarfs Google’s growth, which is 24 percent YoY.

According to Adobe, Facebook’s success is a result of better targeting. 51 percent of U.S. consumers believe Facebook ads are of genuine interest, compared with 17 percent of those on YouTube. Facebook has also decreased the number of ads it shows to appease the large number of users on smaller mobile screens, Gaffney adds.

“[Google is] starting to lose ground as a marketing vehicle and part of the reason why is because they aren’t getting as many clicks out of global display ads,” Gaffney says.

Though Google continues to dominate the search market, other search engines are slowly chipping away at that lead. Google makes up 65 percent of the global search spend share and 61 percent in North America, where Yahoo and Bing’s combined spend has increased 4 percent YoY. China’s Baidu and Russia’s Yandex are continuing to grow, as well, as they start to transcend their respective regions.

Leave a Reply

You must be logged in to post a comment.