Google is allowing advertisers to test Nielsen’s online ad measurement product when they negotiate ad buys on Google’s YouTube, The Wall Street Journal reported.

“We know our clients want meaningful measurement, which is why we’re investing in brand-friendly metrics,” Andrea Faville, a Google spokesperson, told Search Engine Watch. “While we continue to build measurement options powered by Google, we’re also partnering with industry leaders, such as Nielsen and comScore, to offer objective, credentialed, third-party measurement options. Nielsen’s OCR recently joined vCE as a certified measurement provider, and we’re working with both on roll-out plan after we do early testing.”

Google’s decision to let Nielsen to place measurement tags on ads running on YouTube is a reversal of stance taken about two years ago, which some advertisers and media buyers say stopped them from buying more advertising on the online video site. That’s why many industry analysts say Google’s new position could fuel the shift of additional TV ad dollars to YouTube.

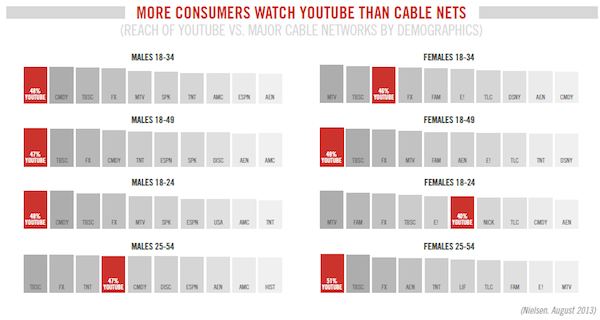

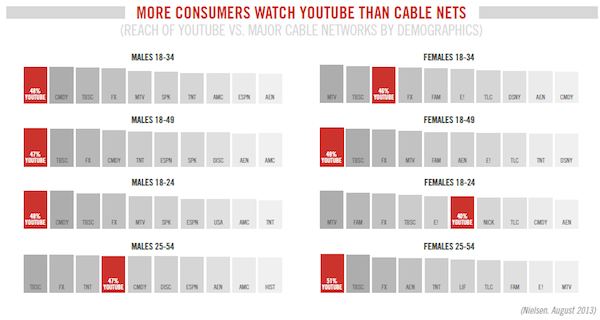

According to the latest issue of YouTube Insights, which was published in October 2013, more consumers watch YouTube than the major cable TV networks. Ironically, the chart below is based on Nielsen data.

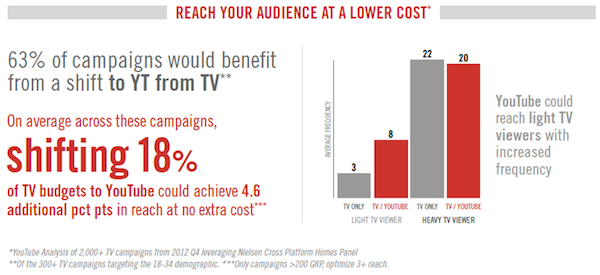

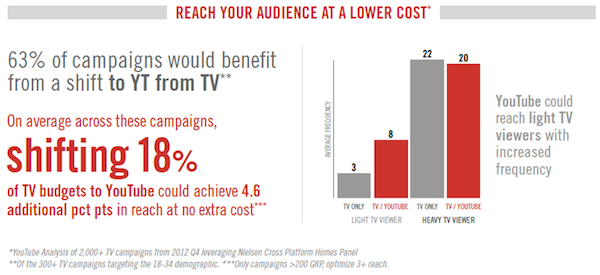

And an analysis by YouTube of TV campaigns from 2012 Q4, which ironically leveraged Nielsen’s Cross Platform Homes Panel, found that 63 percent of the more than 300 campaigns that targeted the 18-34 demographic would have benefited from a shift to YouTube from TV. On average across these campaigns, shifting 18 percent of TV budgets to YouTube would have achieved 4.6 additional percentage points in reach at no additional cost.

In September 2013, Americans viewed 3.2 billion ads on Google sites, driven primarily by video viewing at YouTube, according to comScore Video Metrix. In September 2012, Americans viewed 1.8 billion video ads. So, advertising on YouTube has surged in the past year.

But, following the “early testing” of comScore and Nielsen’s measurement tags, which is expected to be completed by early 2014, last year’s surge in advertising on YouTube could turn into a tidal wave.

Nielsen’s tags allow marketers to monitor the performance of online ads by tracking the number of people who see the ads and how often. Nielsen also provides demographic data about who sees the ads, information it gets partly through a partnership with Facebook in which the social-media site shares information about its users.

Many marketers like Nielsen’s service because it gives them a metric that is comparable to audience ratings in television which Nielsen has long supplied. Advertisers can also make a similar comparison using comScore’s metric, which is known as Validated Campaign Essentials, but some advertisers already have a relationship with Nielsen for other services and don’t want to use two measurement firms.

Google’s previous refusal to accept Nielsen’s tags had upset those advertisers and media buyers, since they didn’t want to accept Google’s own measurement of ads running on YouTube, according to the WSJ article.

Although, it is unclear why Google had refused to accept Nielsen tags until now, some advertisers and media buyers say they had cut back on buying ads on YouTube. Google declined to comment.

Spending on online-video advertising in the U.S. is expected to top $4.1 billion this year, according to eMarketer, up 43 percent from 2012. Spending on TV ads in the U.S. is expected to increase 2.8 percent to $66.3 billion during the same time period. While some advertiser have shifted some of their TV ad dollars into online video the majority of the money being moved has come from online display and print ad budgets, media buyers say.

Google doesn’t break out YouTube’s financial information, but one analyst told the WSJ that YouTube could account for approximately $1.3 billion in U.S. ad revenue, which is about a third of the total U.S. online video marketplace.

This week’s decision by Google to offer third-party measurement options could increase both total ad revenue and its share of the online video market in 2014.

For the more than 1 million YouTube Partners in over 30 countries around the world, who are earning money from their YouTube videos, this news comes as an early holiday gift. Although thousands of their channels are making six figures a year, there are also close to a million partners who are still trying to build a sustainable career on YouTube and beyond.

As Search Engine Watch observed back in July, that’s a large population – larger than the population of Detroit, Vancouver, or Liverpool.

So, finding a way to significantly increase the number of advertisers who are using YouTube and/or the amount of money they spend on YouTube advertising means that fewer poor YouTube Partners are going to face a hard decision this winter: remain starving artists or look for another day job.