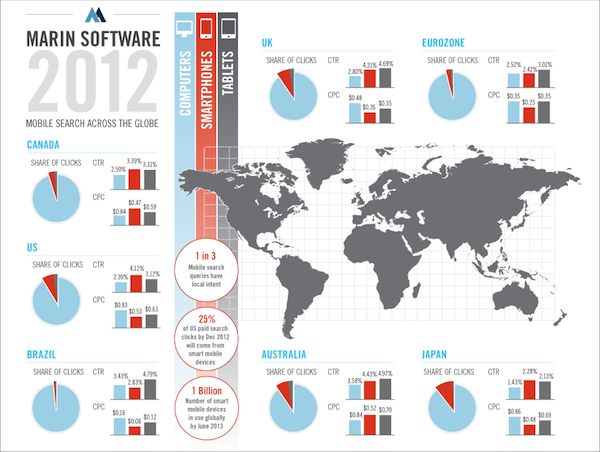

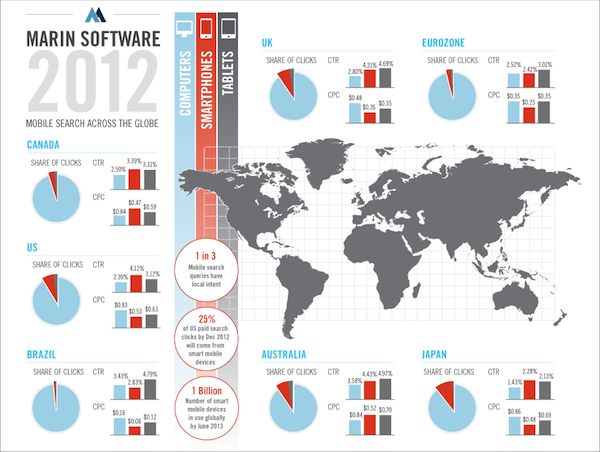

Smart mobile devices will account for 25 percent of all paid search ad clicks in Google’s network by December 2012, up significantly from 5 percent in January 2011. Click through rates (CTRs) on mobile phones are a staggering 72 percent higher than on desktops, though tablet clicks net a lower cost per conversion, according to Marin Software’s State of Mobile Search in the U.S. report.

The explosive adoption of smartphones and tablets, coupled with user behavior, is driving the growth of paid search clicks via mobile devices, said Matt Lawson, Marin Software’s Vice President of Marketing.

In an interview with Search Engine Watch, Lawson said Marin had set out to understand the differences between mobile and desktop for online marketers.

“We have a combination of tremendous consumer demand with favorable performance. We think it’s growing at anywhere from four to eight times the speed that desktop revenues are,” he said. Lawson noted this is significant, as the desktop advertising market is also growing quickly.

Mobile Adoption Driving Increasing Clicks, Spend

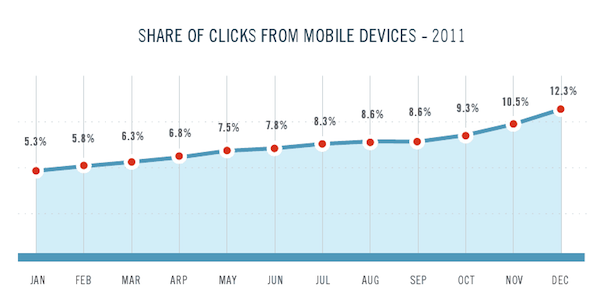

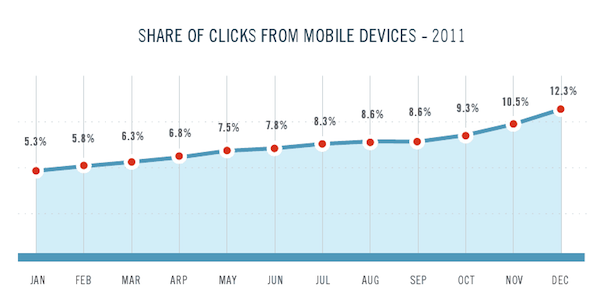

Marin calls 2011 a “watershed year” for mobile search, with an almost 7 percent increase in clicks on mobile devices, from 5.3 to 12 percent, as a portion of all Google ad clicks from January to December 2011.

Ad spend on mobiles increased even more, as advertisers increased their mobile search spend (as a portion of search budget as a whole) from 3.4 to 8.7 percent. Marin predicts that mobile will account for 25 percent of all paid search clicks by the end of 2012. They also forecast the global smart mobile market will reach one billion devices in either the first or second quarter of 2013.

“The growth in click share is dramatic. Ad dollars are pouring in to chase this, but not as fast as click share is rising,” Lawson said. “Cost per click on mobiles were lower in 2011 than for desktops, so for advertisers, that means mobile is a very favorable environment from a performance perspective.”

Mobile Clicks from Tablets Rising, Cost Per Conversion Stays Low

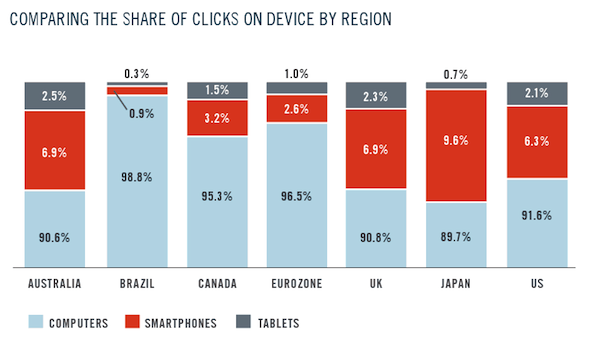

In their report, Marin said, “…allocating budget across tablets and smartphones can depend on an advertiser’s industry, audience and geography.” In the absence of more precise data, they suggest, the fraction of clicks from tablets versus total mobile clicks is a good proxy for the percent of search budget to allocate towards tablets. To that end, they anticipate tablets will account for 45 percent of all mobile clicks by December 2012.

In comparing paid search ads performance on desktops vs. smartphones or tablets, Marin found that desktop ads actually have the lowest CTR, at 2.39 percent. This is in comparison to tablets and smartphones at 3.12 and 4.12 percent, respectively. Smartphones had the lowest cost per click, at $0.53. Tablet ads cost, on average, $0.63 per click, while desktops were highest at $0.83.

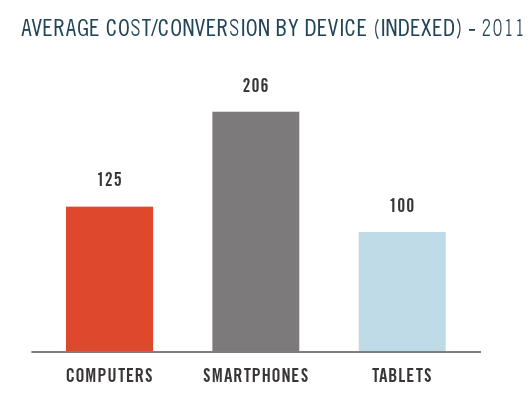

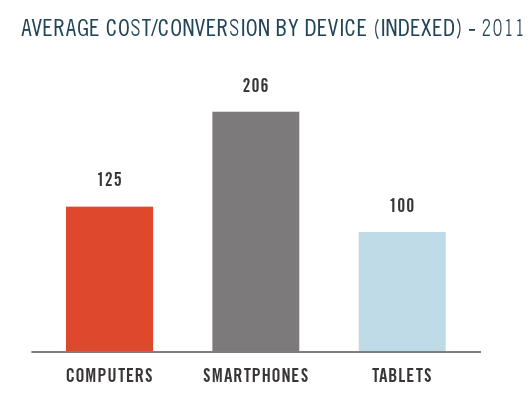

However, smartphones didn’t convert as well; the average conversion rate on smartphones was just 2 percent, compared to 4.9 percent on tablets and 5.2 percent on desktops.

Unsurprisingly, given their decent CTR, low cost per click and a conversion rate nearly as high as on desktops, tablets boasted the lowest cost per conversion. Desktops cost 25 percent more per conversion, on average, while smartphones were 206 percent more.

The popularity of tablets is not surprising, said Lawson.

“You can zoom in, you have a better screen, it’s not surprising that the shopping experience could be better,” he said. “For smartphones, the data doesn’t probably tell the whole story. It’s probably very rare that you would pull out your credit card and buy over your phone. The challenge with measuring mobile is that you need to try to measure how offline conversion is affected.”

Brazil & Japan Emerging Markets for Tablet & Smartphone Advertisers

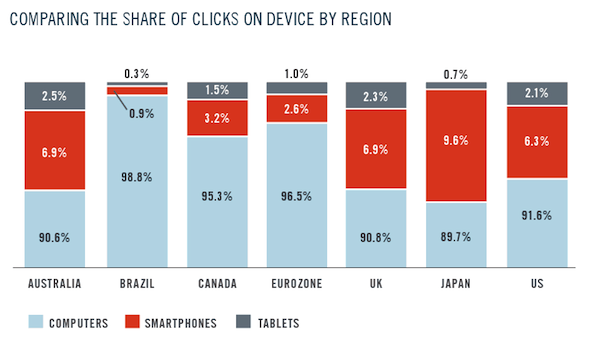

Mobile devices are in a position to “leapfrog” desktops in bringing e-commerce to billions the world over, the report noted. Marin analyzed data from a number of countries and the Eurozone, then broke out share of clicks and ad spend, as well as device-specific cost per click and CTR for each region (more graphs available in the full report).

The Brazilian online ad market is still largely dominated by desktop transactions, with just 0.3 and 0.9 percent of clicks on tablets and smartphones, respectively. Advertisers there are spending very little on mobile paid search, with tablets and smartphones together taking just 0.6 percent of spend.

Still, 4.79 percent of paid search clicks in the region come from tablet users. The cost per click in Brazil is also lower for tablet ads, at $0.12 compared to $0.16 for desktop.

In Japan, smartphones have been much more widely adopted than in Brazil. However, tablets have a ways to go, accounting for just 0.7 percent of all clicks, to 9.6 percent on smartphones.

When it comes to paid search ad spend, Japanese marketers spend 93.8 percent of their paid search market on desktop, although it accounts for only 89.7 percent of clicks. That, combined with the fact that desktop converts less and costs more per click, means there is quite a bit of opportunity in the mobile ad space for marketers.

Alongside The State of Mobile Search in the U.S., Marin Software also released a corresponding infographic, Mobile Search Across the Globe.