10 Missed Opportunities in Search Engine Marketing in Japan

Why Japan is the most difficult country to provide both natural search engine optimization and paid search marketing service for. Part one of two.

Why Japan is the most difficult country to provide both natural search engine optimization and paid search marketing service for. Part one of two.

Japan is a highly developed “wired” country, has a similar e-commerce infrastructure, uses both Google and Yahoo, and is the global leader in blogs and 3G mobile usage. Yet the failure rate among multinational search marketers trying to succeed in Japan is by far the highest in the world.

To really understand why it’s so difficult, we first need to understand the missed opportunities that aren’t so apparent. I found 10, but quickly ran out of room for this column, so we’ll cover the first five today, then the remainder in my next column.

Missed Opportunity 1: Google, Yahoo or ?

When targeting a nation with multiple search engines, it’s a good practice to focus on a primary. A primary will allow you to develop your keywords with strong analytical backing, maintain an organic structure by following one search engine’s rules, and lead you to the most amount of traffic.

Let’s start by looking at Japan’s search engine market and paid search market to determine your primary search engine to focus on.

Japanese Search Engine Market Share

Graph courtesy of Infocubic.co.jp

In the Japanese search engine market share graph, Yahoo Japan and its partnerships continue to hold the market while Google and its partnerships continue to remain in second place. Although other search engines are on the market, their share is so insignificant at this time that it may not be to your focal advantage.

Japanese Advertising Spend (Paid search) Market Share

Graph courtesy of Infocubic.co.jp

When you look at where the ad spend goes on the Japanese advertising spend graph, you’ll likely be surprised at the significant share Yahoo Japan (Overture) obtains. Many marketers assume it’s 50/50 between the two search engines and many global advertisers only advertise on Google.

Yahoo Japan should be your priority focused search engine. Not only does it have the most reach, it also has a better layout that appeals to the Japanese user, which means more clicks to advertisers. Take a look at this recent eye tracking study provided by CNET comparing the SERPs of Google Japan with Yahoo Japan.

Interestingly enough, the test subjects seem to view paid search results at around 30 percent on Yahoo Japan and Google at around 5 percent. There are many factors here to also consider, four ads compared to three, bigger font, paid versus organic relevancy, etc.

Yahoo Japan is more consumer oriented and Google is more business oriented. Not to say Google misses out, they have a great shopping portal, but more consumers utilize its competitor.

Missed Opportunity 2: Mobile Search

Looking at the search market share is easy enough, but a huge portion of the Japanese search market has been left out of these graphs. The Japanese mobile search market is massive and is growing faster than green grass through a goose.

This isn’t surprising, considering they are the global leaders in 3G mobile usage reaching over 50 million users. Yet, many of us search marketers are left wondering, is mobile is just too young to be mature at this stage?

The point is that if you believe the market is too small, then you may have another missed opportunity if you aren’t implementing or making plans for a Japanese mobile search campaign. The smartphone adoption rate and the iPads in Japan are already booming.

The Mobile Computing Promotion Consortium of Japan cites more than 55 percent growth in smartphone adoption and web surfing as the second most popular activity just under reading e-mail. In 2010, according to the MM Research Institute, Apple’s iPhone has already claimed 72 percent of the smartphone market in less than a year. So who leads in mobile search?

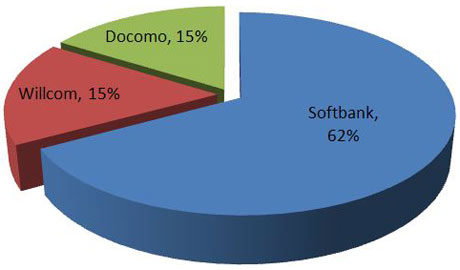

Japanese Mobile Market Share

Research and Markets, 2010 Mobile Operator Forecast

From looking at the Japanese mobile market as a whole, Google Japan is the leader with its search partnerships with Docomo and KDDI with Softbank in third place. Yahoo Japan powers Softbank phones (and vice versa, considering Softbank is the majority stock holder of Yahoo Japan).

Japanese Smart Phone Market Share

Google may have the mobile market share down well in Japan, but the largest user base is on smart phones. Yahoo, is the clear winner today, holding the largest mobile search smartphone market.

Missed Opportunity 3: Landing Page Design

One thing the Japanese have in common with the Germans is their ability to look at things on a page with a quality and technical factor. However, both cultures are far apart when it comes to a design of a page.

Generally, Asians don’t mind what we in the West consider “busy.” So, what are the most important items of a Japanese landing page that resonate well with the Japanese user and increases conversions?

In this McAfee landing page example, there are lots of offers, diagrams, and big clickable graphic buttons. It’s pretty busy with nearly all of the white space taken.

So the key to this missed opportunity is not carrying over the same look and feel of your Western landing pages. Mix it up and make it busy with good and relevant data points that will captivate your audience.

Missed Opportunity 4: Paid Links

By Western standards, and according to Google, paid links are a big no-no. However, you might be surprised to find out that Japan is an exception. I’m torn because I can see from a search engine’s perspective that it manipulates their link values. But if you monetize your site with ads, why can’t you sell links if your site is popular?

A few years ago, paid links took off like a scalded chimp in heat in Japan. To the frustration of many experienced search optimizers, most of these new “Japanese SEO Experts” were nothing but link brokers. This is particularly frustrating when your client’s competitors outranked you within days for no apparent reason. Add to the fact that trying to get ethical links from publishers became more and more difficult as more sites chose to monetize them.

So today, they remain to have a don’t ask, don’t tell policy. Although there are still some hard working natural link builders in Japan, they may be few and far between. Most SEMs in Japan now provide both, that is, without much transparency. Yahoo doesn’t penalize you for paid links and they have the market share. Enough said.

Missed Opportunity 5: Hosting and TLDs

Although hosting in Japan isn’t necessary, you can still benefit from having your site hosted in Japan. A server in Japan actually works in your favor because, not only do you no longer have to worry about connectivity issues, but your server gives search engines a feeling that you’re local. Being local to a search engine, gives you a nice little benefit over those with servers outside of the country.

The TLD of Japan is “.jp” and “.co.jp”; however, the latter is preferable, as it lends an additional trust benefit. Having a Japanese TLD provides you with a search benefit, but a trust benefit will go a long way with looking and behaving more local to the Japanese market. It’s a major missed opportunity if you’re running on a Japanese domain extension.

Recently, ICANN allowed non-Latin characters in domain names for Japanese and other languages. This really hasn’t taken off yet in Japan even though it’s fun to hear about the discussions of Kanji characters because users often can’t identify whether a domain is Japanese or Chinese.

In “10 Missed Opportunities in Search Engine Marketing in Japan, Part 2,” we’ll cover translations, keyword research, blogs, social media, Japanese trust factors, and a big bonus secret missed opportunity that few people know about.

Thanks to my friends at Wasabi Communications and Infocubic for their great feedback.

Join us for SES San Francisco August 16-20, 2010 during ClickZ’s Connected Marketing Week. The festival is packed with sessions covering PPC management, keyword research, search engine optimization (SEO), social media, ad networks and exchanges, e-mail marketing, the real time web, local search, mobile, duplicate content, multiple site issues, video optimization, site optimization and usability, while offering high-level strategy, keynotes, an expo floor with 100+ companies, networking events, parties and more!